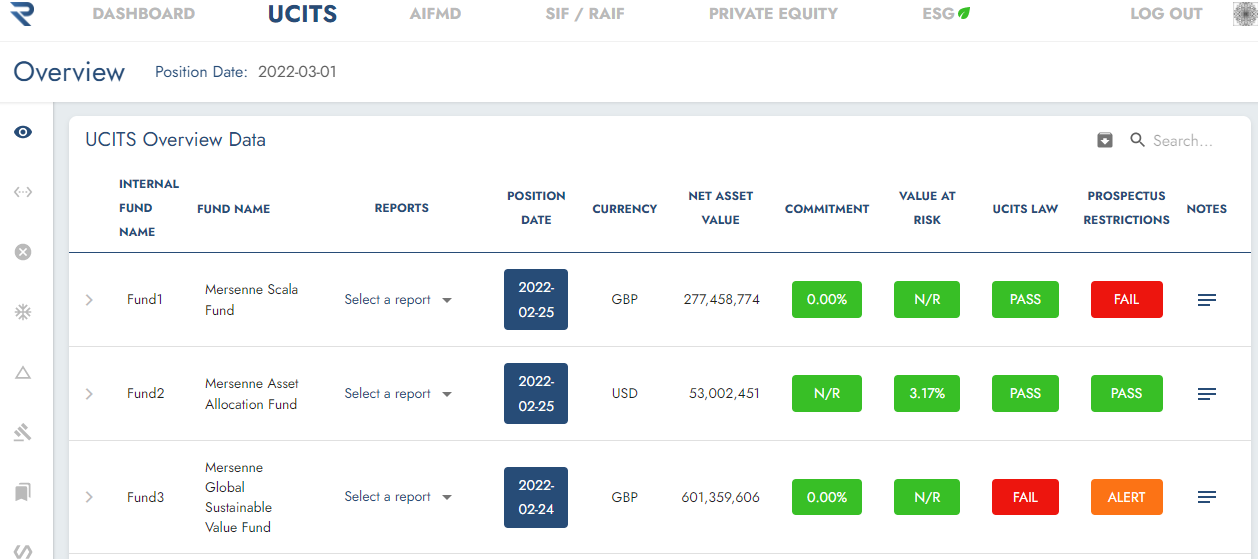

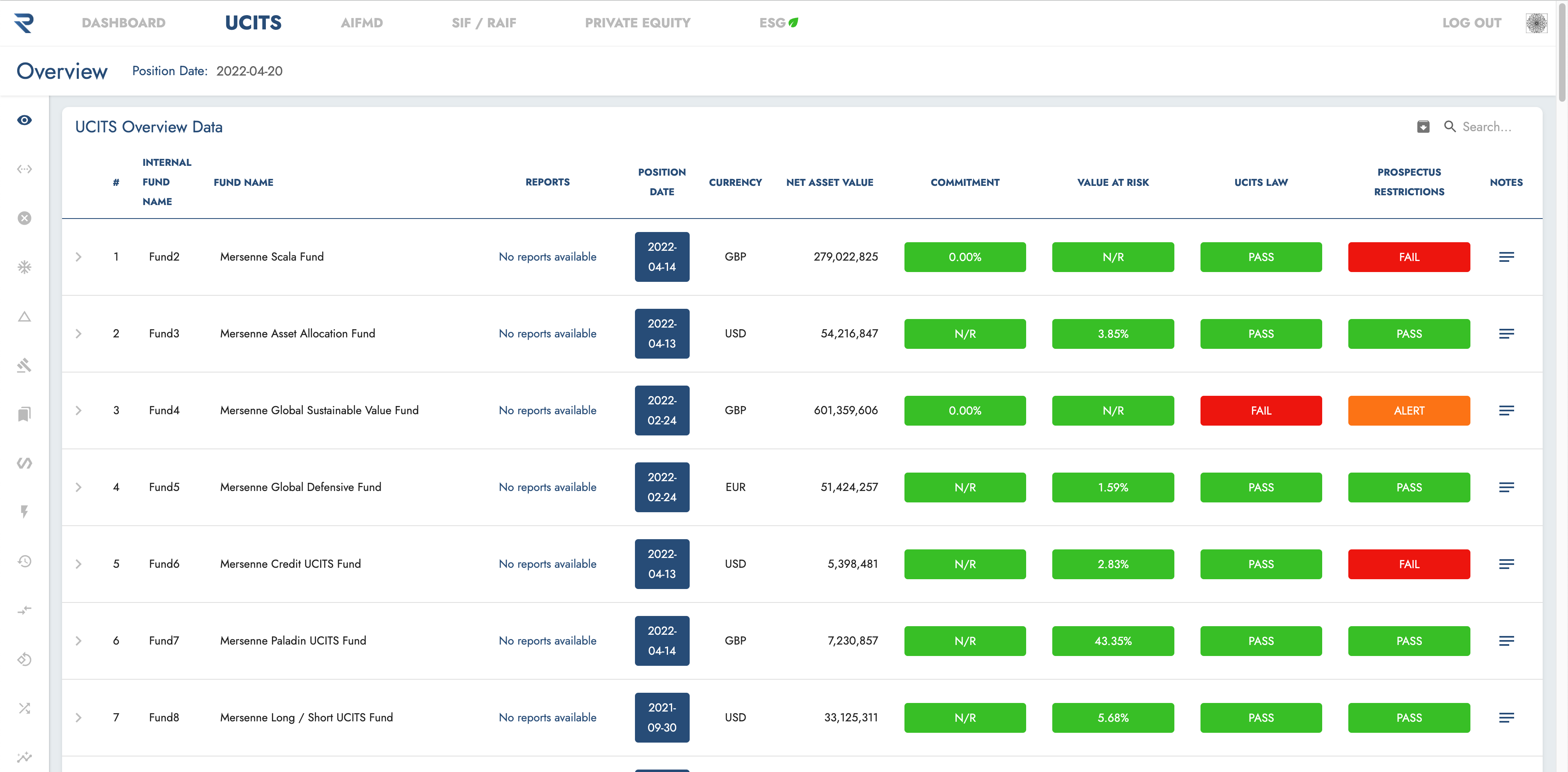

UCITS Reporting

Comprehensive UCITS reporting ensures nothing is missed.

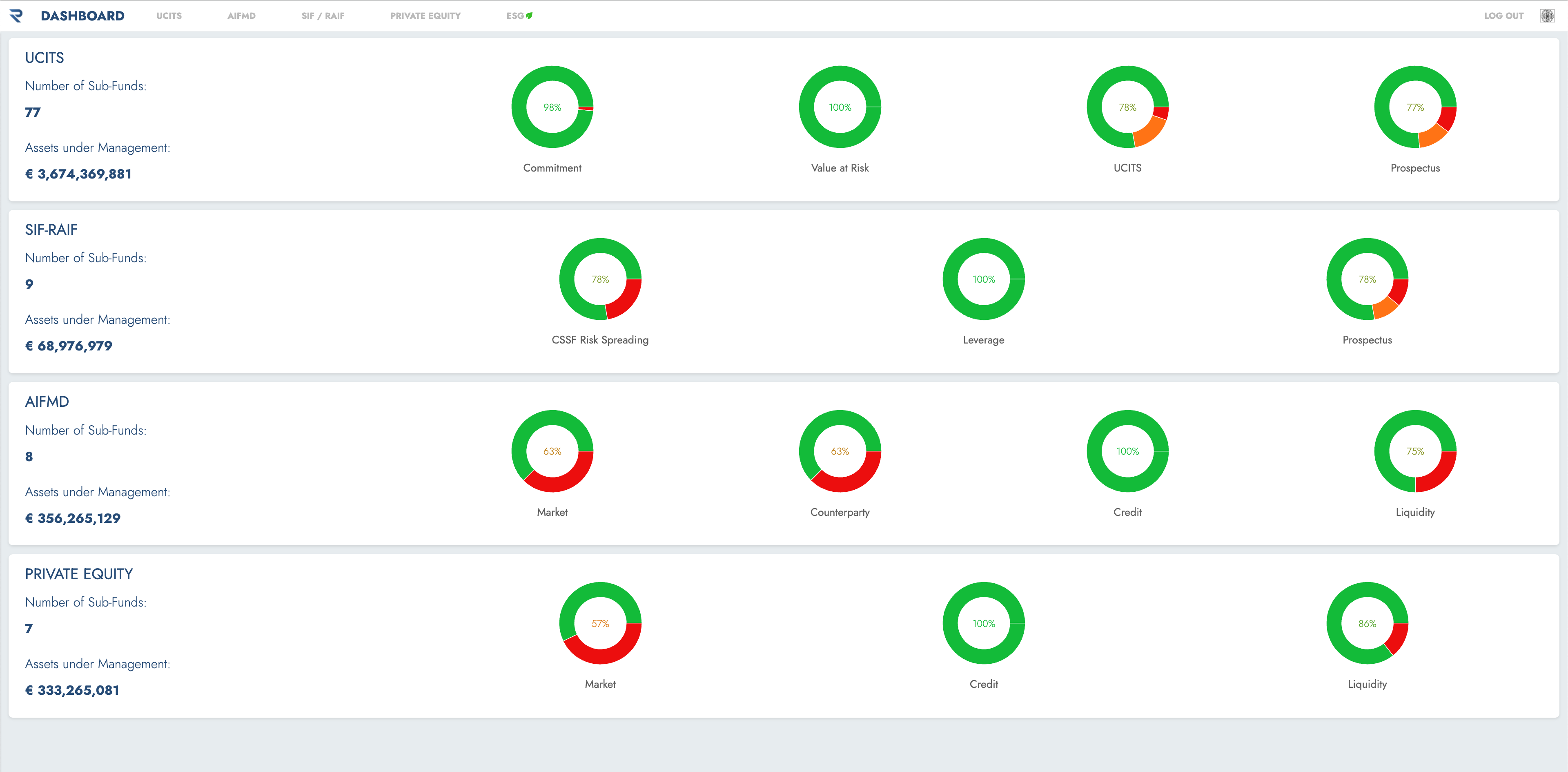

The RiskSystem proprietary risk management software allows complete oversight of your funds on a single dashboard.

This integrated system allows the user to perform:

- Rapid Investigation of breaches

- Extensive drill-down into individual positions

- Oversight and commentary on the autonomous audit trail

AIFMD Reporting

The RiskSystem AIFMD solution ensures full compliance with all aspects of your Regulatory risk obligations.

Our flexible solution can capture the risks associated with even the most complicated funds.

This array of AIFMD risk management analytics include, however are not limited to:

- Market risk

- Counterparty risk

- Credit risk

- Liquidity risk

- Prospectus limit monitoring

* Bespoke functionality in any of these areas can be provided at the request of the user.

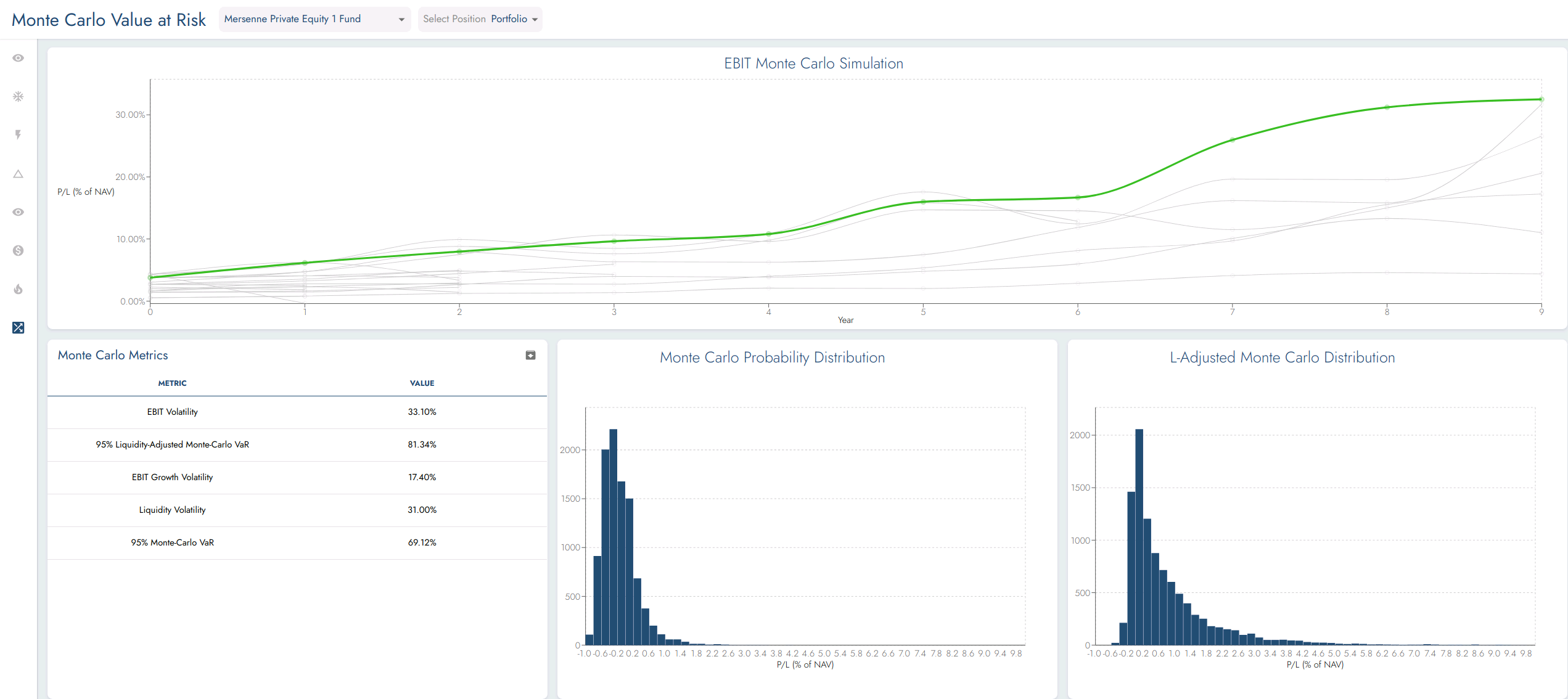

Private Equity & Real Estate

Risk Management functionality that has been specifically developed for both Private Equity and Real Estate funds.

This risk management functionality is built using a blended model which consists of a:

- Discounted Cash Flow Model

- Market Proxification Model

Using this propitiatory model, RiskSystem can create unique insights while also providing analytics across all the traditional risk management areas such as Market Risk, Liquidity risk and Stress testing.

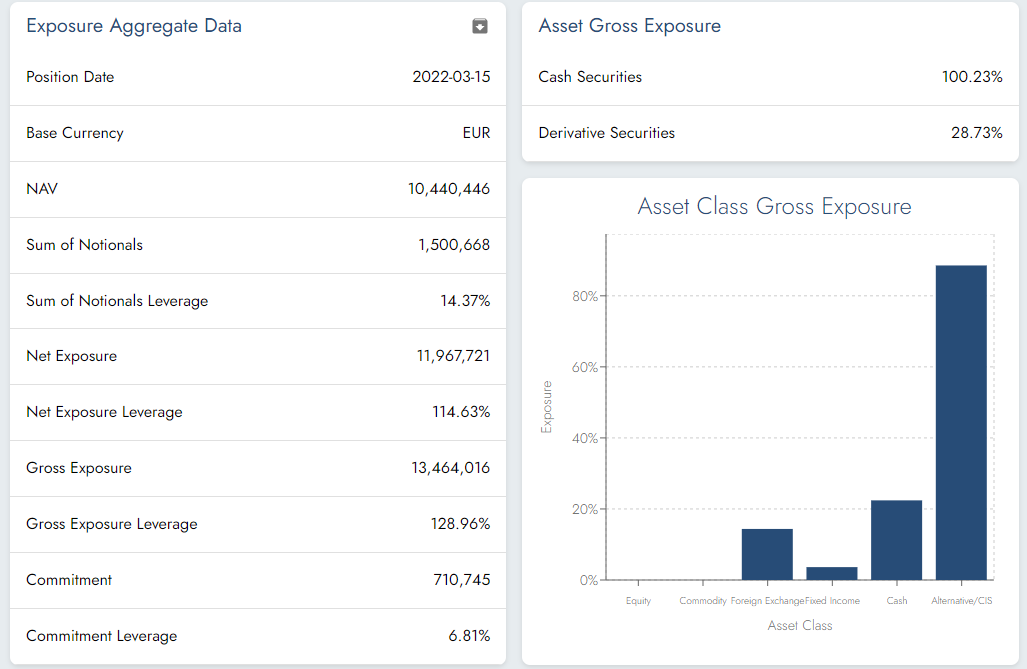

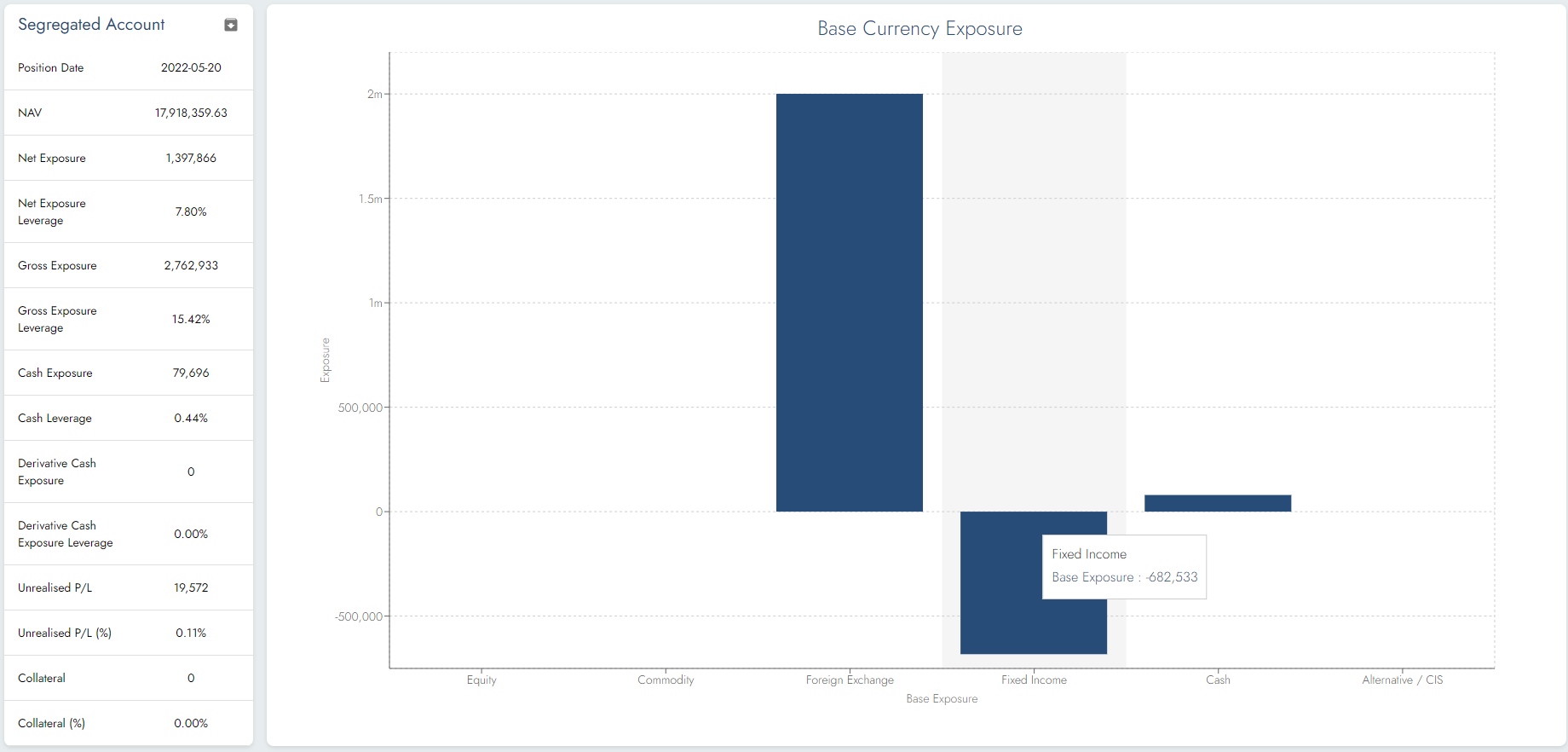

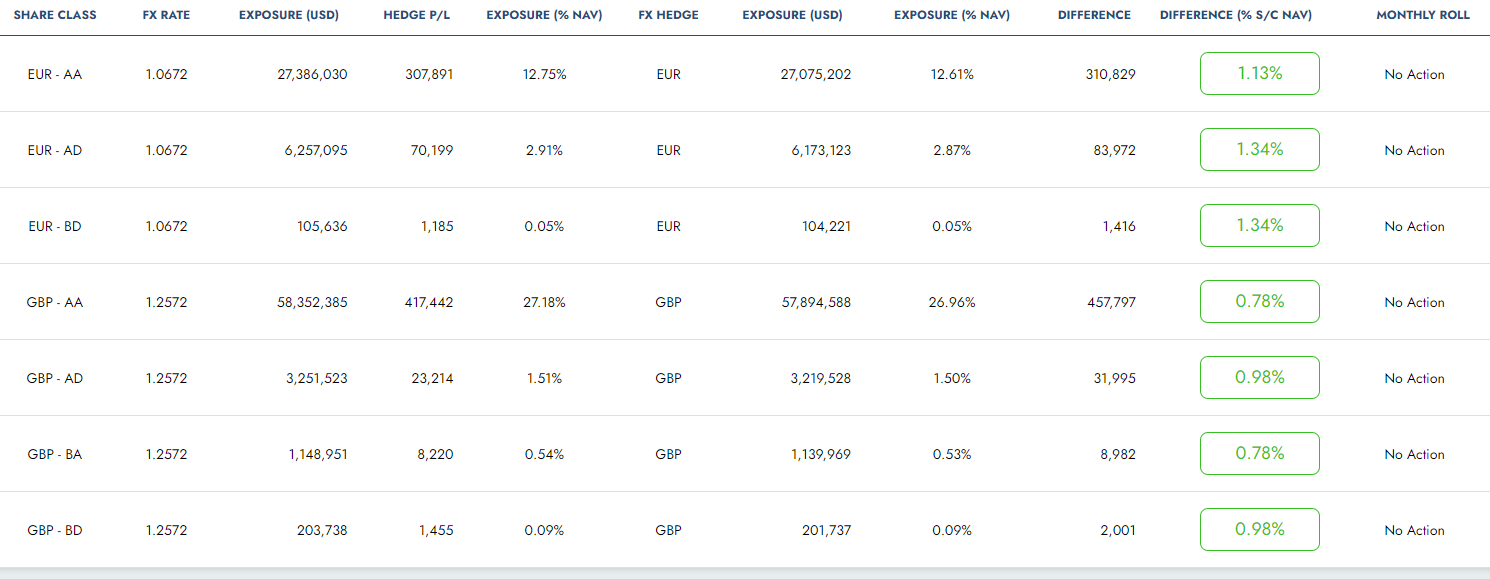

Exposure Oversight

RiskSystem provides all the standard exposure metrics which a user needs to adequately monitor their funds.

However, in addition to this, RiskSystem also provides extensive exposure analysis from various perspectives such as:

- Asset Class

- Asset Type

- Currency

- Country

- Sector

All exposure metrics can be reviewed and assessed on single dashboard with extensive drill-down capacity and instant access to historical data.

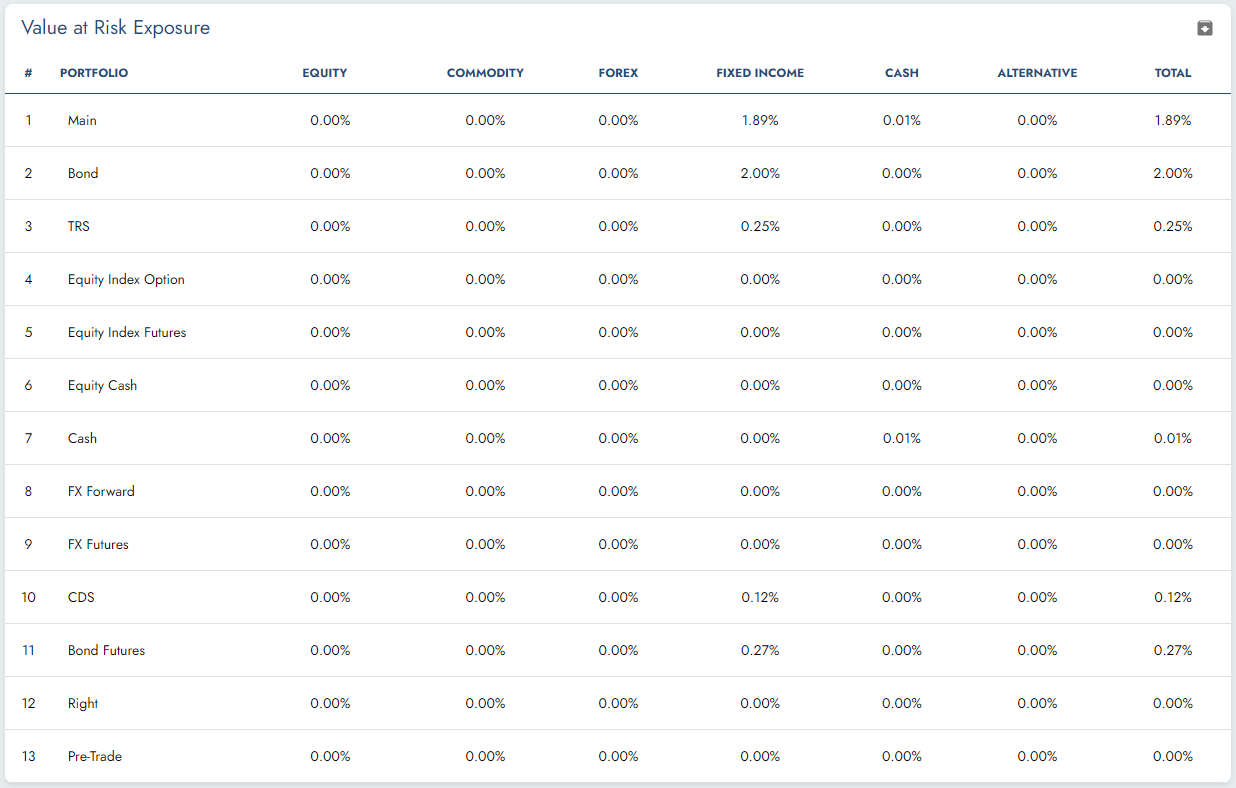

Value-at-Risk (VaR)

RiskSystem operates a proprietary multi-model VaR engine that can implement a variety of VaR methodologies which includes models such as the:

- Parametric Model

- Historical Model

- Monte-Carlo Simulation Model

- Cornish-Fisher Model

In addition, RiskSystem has developed discrete VaR models designed to quantify the Value-at-Risk derived from specific strategies such as Merger-Arbitrage and asset classes such as Catastrophe Bonds.

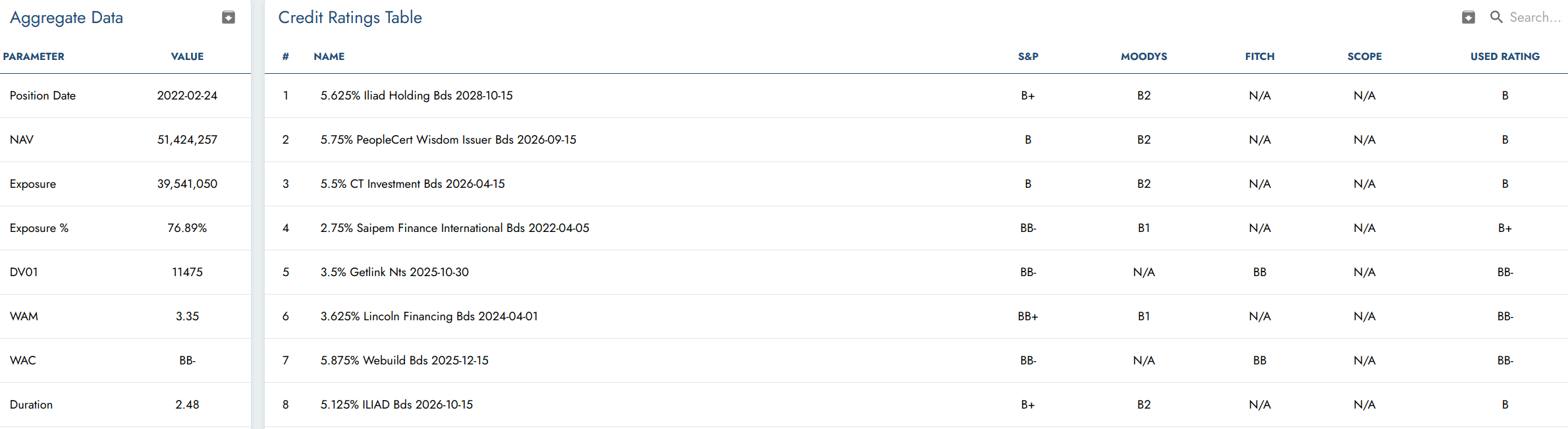

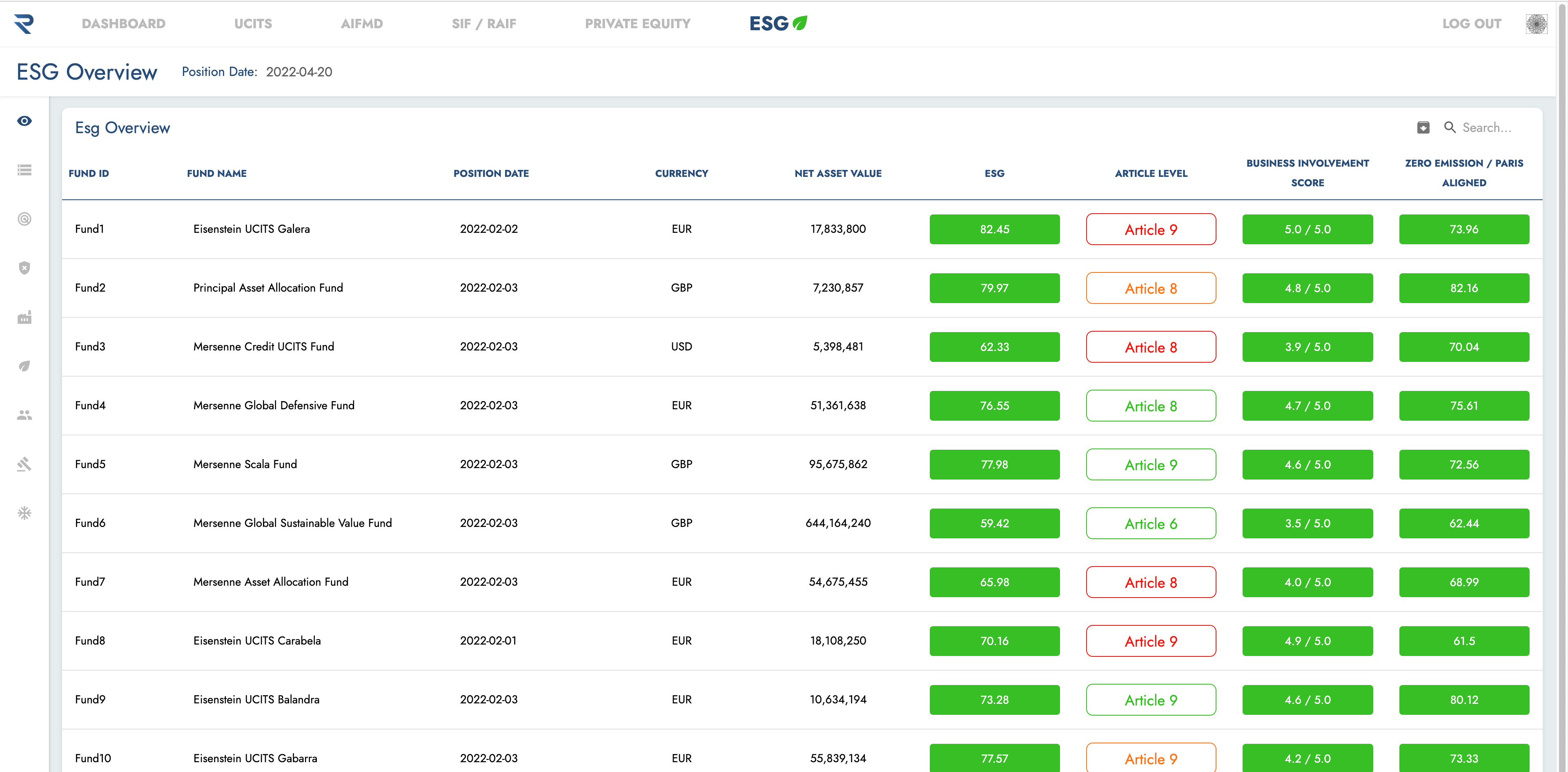

Credit Risk

RiskSystem provides comprehensive coverage of the credit ratings provided by each of the credit rating agencies.

RiskSystem also provides additional credit risk metrics such as:

- DV01 – At both the Fund level and Position level

- Weighted Average Maturity (WAM)

- Weighted Average Credit Rating (WAC)

- Duration of the Fund

Market Risk

Our Market Risk functionality is at the heart of what we do. We offer a complete landscape of Market Risk measurements, including:

- VaR

- Component Var

- Commitment

- Gross Exposure

- Option Risk Parameterisation

- Sector Component Risk

- And more ..

All within our intuitive and transparent Graphical User Interface – RAPTOR

Counterparty Risk

RiskSystem provides complete Counterparty Market Risk and Credit Risk analysis for the whole portfolio.

Breaking down the historical risk associated with the positions of the counterparty and summarising the various quantifiers used in assessing the risk of a counterparty default, RiskSystem derives the measures of credit risk such as:

- Credit Value Adjustment

- Wrong Way Risk.

Stress Testing

At RiskSystem we carefully manage our stress testing methods to provide complete oversight over worst case scenarios which includes:

- Historical stress testing algorithms, which rigorously analyses the effect of past scenarios against the current portfolio with robust correlation tests and blanket downturns in measured historical quantifiers

- Bespoke hypothetical testing, modelling drops in asset markets, currencies, and Flight to Safety, all while tracking these effects on the P/L, Volatility, etc.

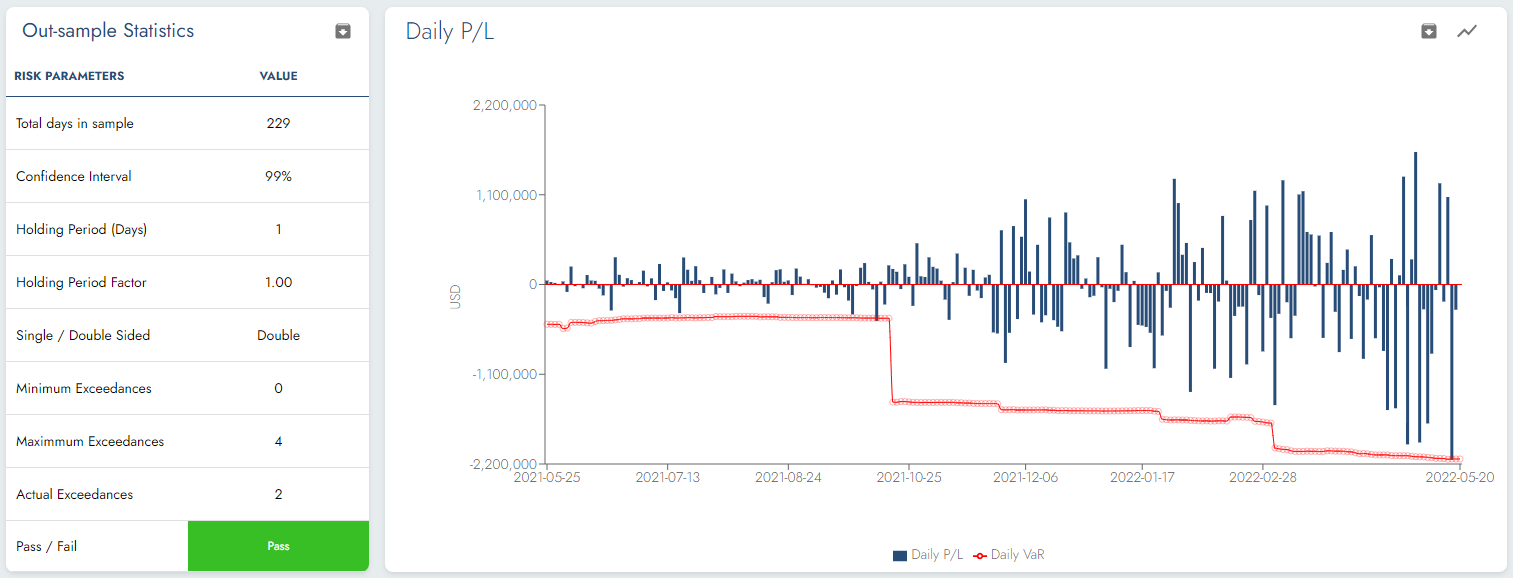

VaR Backtesting

To accompany RiskSystem’s VaR models with correct validation, we provide a variety of tools such as historical back-testing, parametrical back-testing, simulations and stress testing.

All VaR backtests can be conveniently exported for further reconciliation or regulatory filings, all in compliance with the UCITS VaR exceedance regulations.

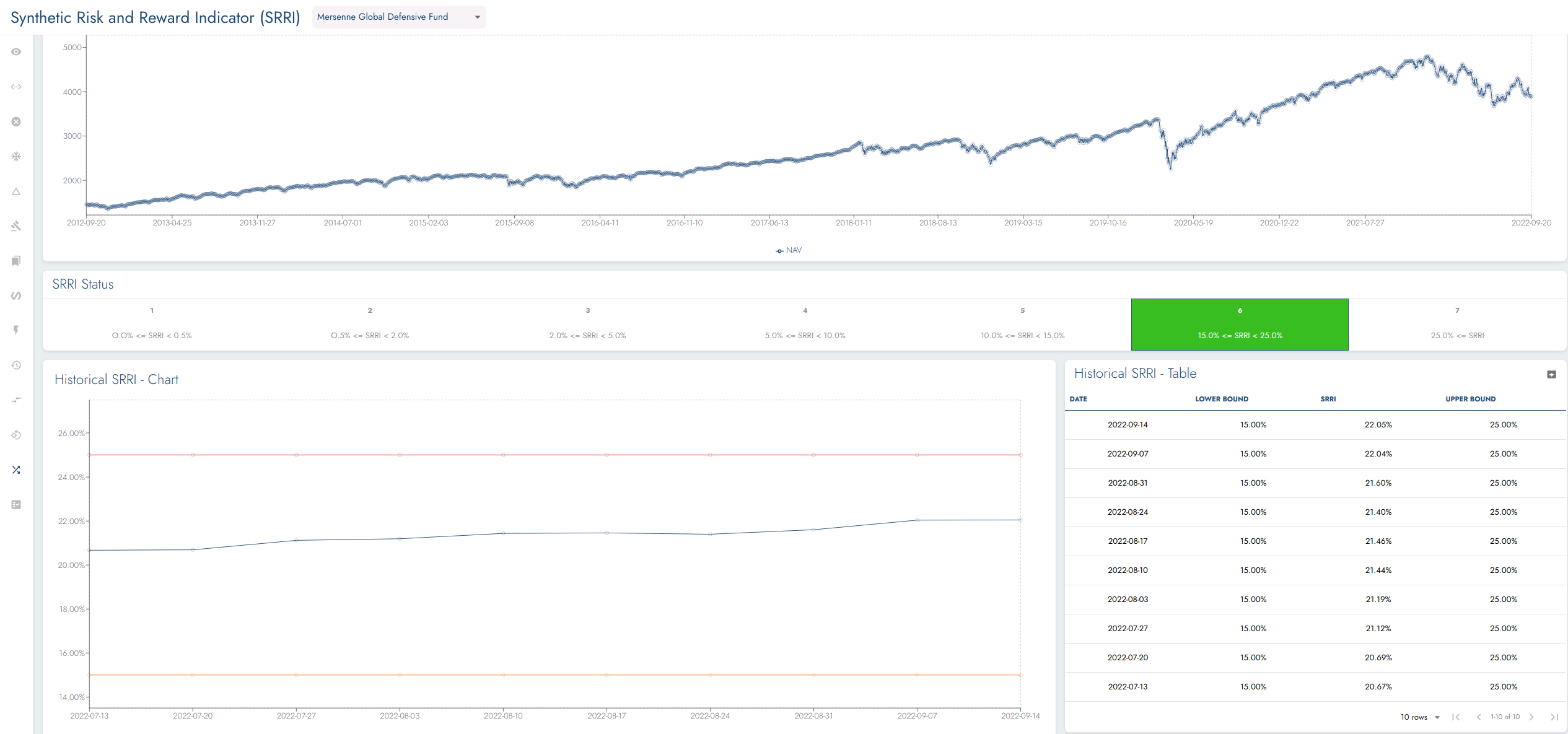

SRRI

As an integral part of the Key Investor Information Document (KIID) for UCITS funds RiskSystem monitors the SRRI according to the regulations (CESR/10-673) for all share classes while providing exact calculation breakdowns for reconciliation and handling all edge cases such as dividends, proxies and benchmarks.

By extension of the SRRI, we also provide functionality for independent generation of a users KIID accessible via RAPTOR.

Pre-trade

RiskSystem offers a pro-active rather than a re-active process to portfolio alterations.

Using our Pre-trade functionality, our clients can pre-enter positions into their portfolio and assess the resulting effects on their fund’s risk exposures and compliance before entering them in the market.

Tracking Error

RiskSystem’s Tracking Error engine calculates the divergence between the price behavior of the portfolio and the price behavior of a benchmark.

RiskSystem can be configured to monitor the Tracking Error for any time-frame, any benchmark and other fund specific configurations.

Key Features

RiskSystem offers many advantages over competing risk solutions

Integrated

The risks of any number of sub-funds are integrated into one portal.

Customisable

All functionality and reporting can be tailored to clients requirements.

Comprehensive

All instruments and fund types covered.

Scalable

Our internally developed functionality ensures rapid on-boarding of new funds removing any constraints on growth of funds under management.

Full Managed Service

Sourcing, cleansing, enriching and processing all data from any preferred source in any format is our responsibility.

Secure

All data and risk analytics are stored in a highly secure private cloud.