CSSF

The Luxembourg CSSF Semi-Annual UCITS Reporting is an integrated function of the RiskSystem engine. Our in-house system allows for quick and easy regulatory reporting without the need to source additional information from our clients.

KIIDs

KIID Production

- Once a template is uploaded RiskSystem can automatically produce a finished KIID from the system.

- Tracked change version is supplied to show any changes since the previous (or earlier) drafts.

KIID Calculations

- RiskSystem automatically calculates all funds’ SRRI’s and on an ongoing basis monitors the SRRI for consistency with the KIID

PRIIPs

The RiskSystem PRIIPs solution is an automated end-to-end workflow process that on an ongoing basis collects the required inputs from the relevant source, calculates the various metrics and outputs required (MRM, SRI, RIY, CRM, etc), and automatically populates and produces a European PRIIPs Template (EPT) or other data exchange template, and if required a complete KID.

CPO-PQR

RiskSystem offers the full range of CPO-PQR services with a system in-place to process and submit reporting for small, medium and large size CPOs. With this system, and our experienced risk analysts, RiskSystem ensures timely delivery of regulatory CPO-PQR reporting.

Annex IV

At RiskSystem we support you in Annex IV reporting obligations, file and submit reports on your behalf and ensure a smooth efficient reporting process.

The RiskSystem Annex IV service involves:

• Integrates administrator data, time series data and indicative / meta data

• Aggregates all position / risk data into the appropriate Annex IV Schema

• Provides signature ready XML files with supporting documentation

Form PF

Our range of regulatory reporting services includes Form PF services to our clients. Working with our clients, we will ensure a smooth process is established and that reporting is submitted in an efficient and timely manner.

Open Protocol

RiskSystem provides a fully automated hassle-free production of such reports at the touch of a button through our precise data analytics functionality, replacting the copy-and-paste template method that the Open Protocol method of reporting demands, providing ease of mind and complete compliance to the regulations.

EMIR Oversight

At RiskSystem our objective is to provide oversight for all the regulatory responsibilities of our clients.

RiskSystem provides daily EMIR (European Market Infrastructure Regulation) calculations at both a Manco level and sub-fund level to allow our clients to review the contribution of each of their funds to the EMIR limits.

Key Features

RiskSystem offers many advantages over competing risk solutions

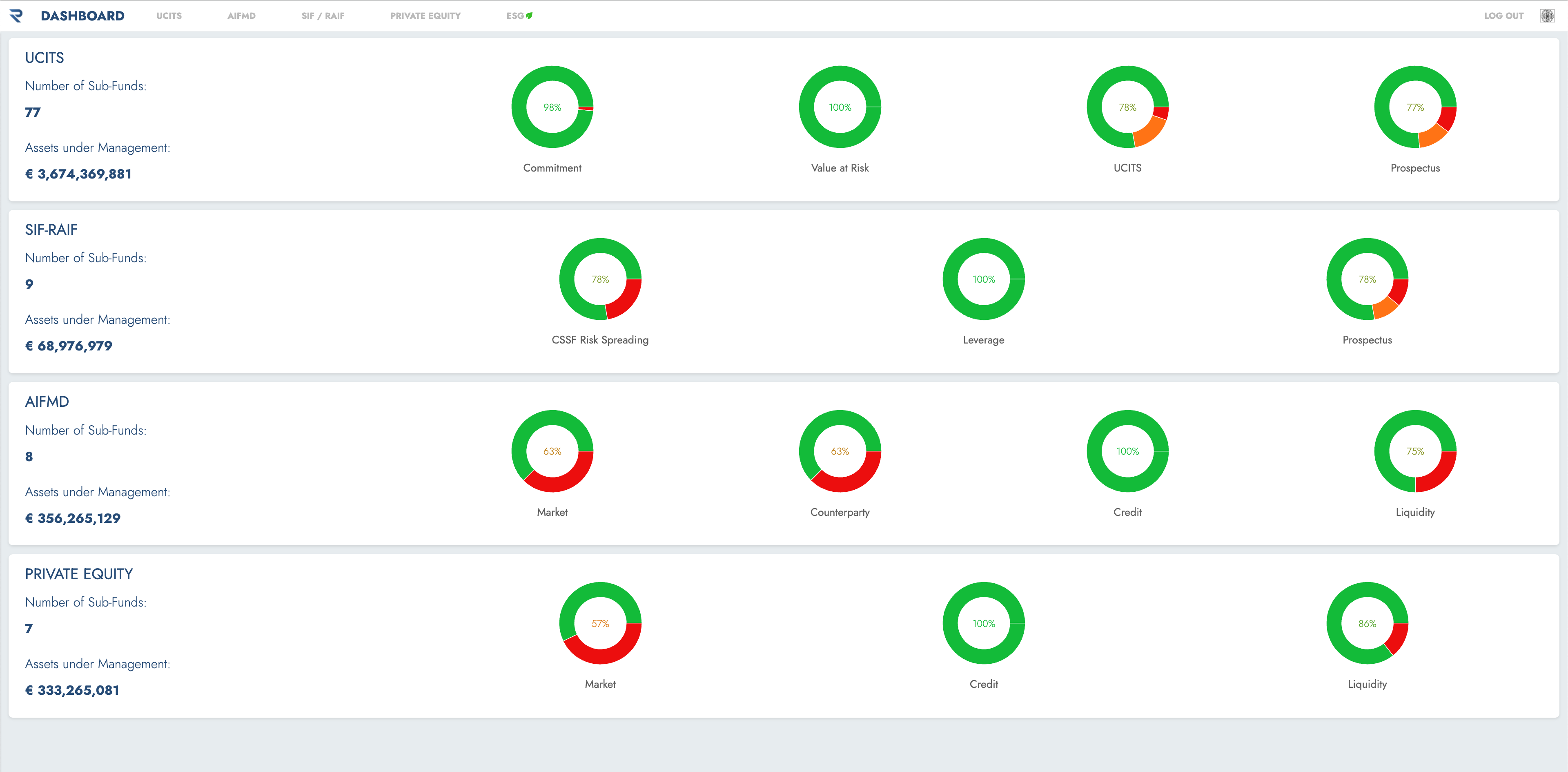

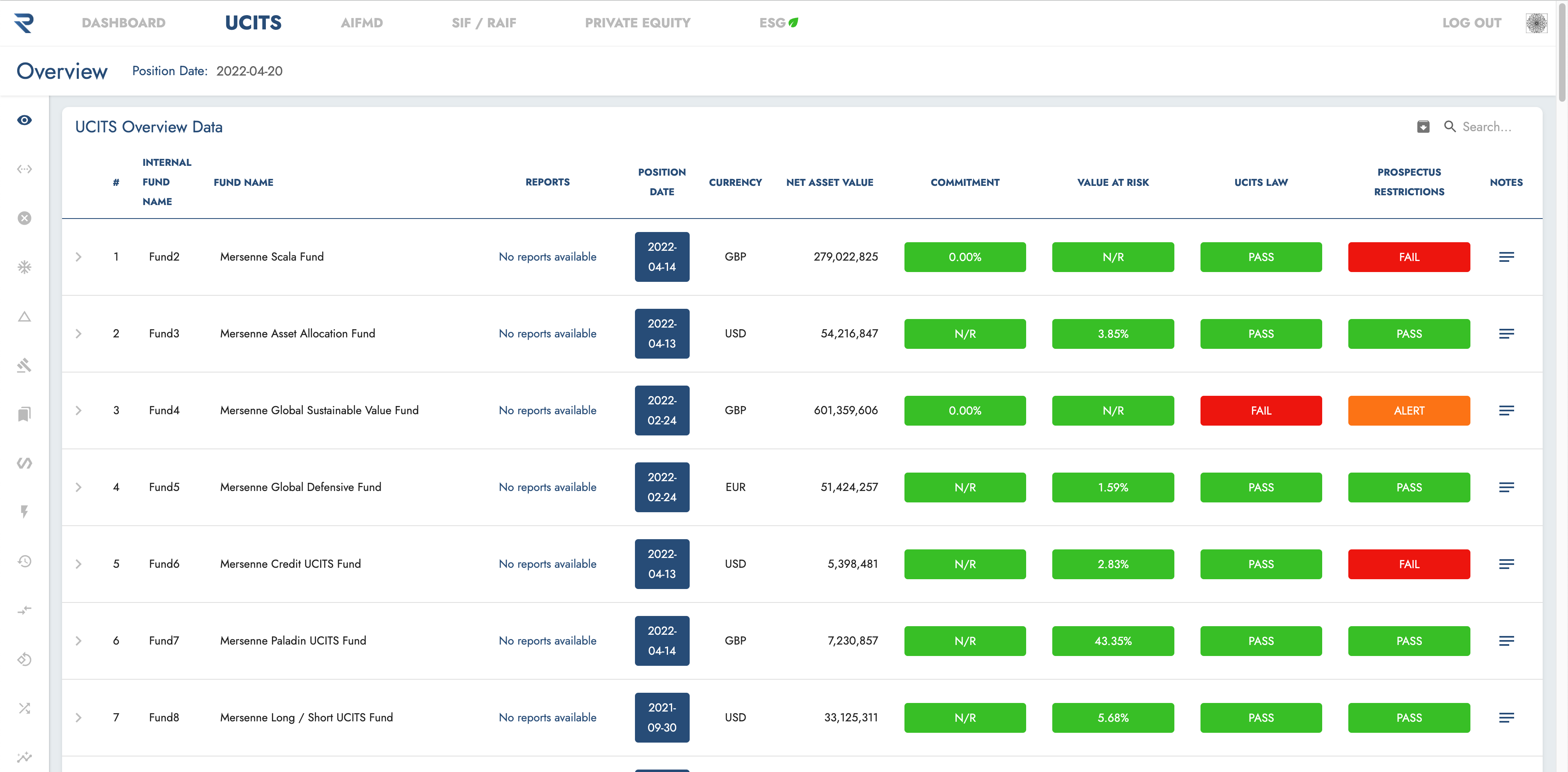

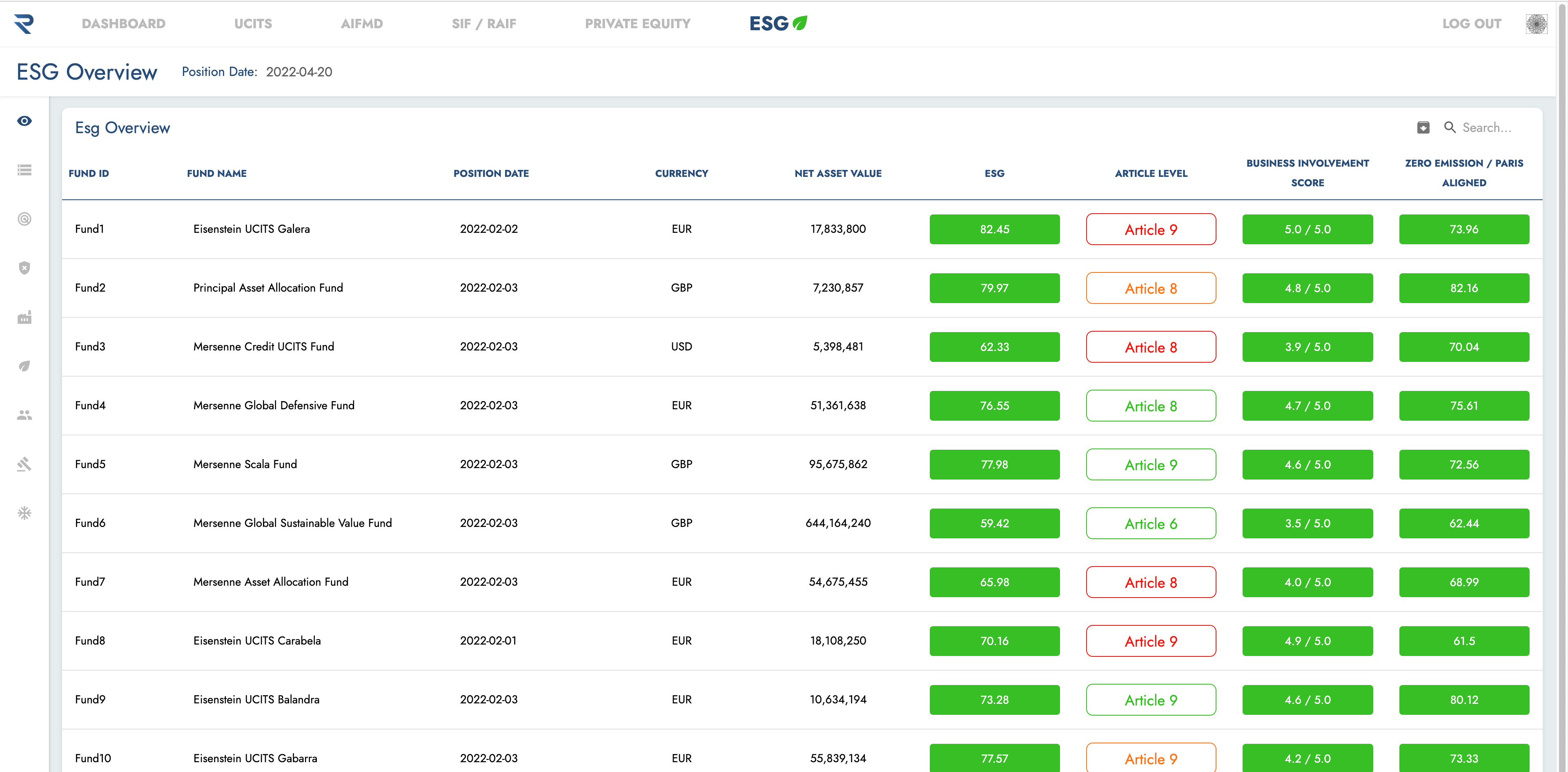

Integrated

The risks of any number of sub-funds are integrated into one portal.

Customisable

All functionality and reporting can be tailored to clients requirements.

Comprehensive

All instruments and fund types covered.

Scalable

Our internally developed functionality ensures rapid on-boarding of new funds removing any constraints on growth of funds under management.

Full Managed Service

Sourcing, cleansing, enriching and processing all data from any preferred source in any format is our responsibility.

Secure

All data and risk analytics are stored in a highly secure private cloud.