Risk Down Under

We keep a wary eye on what is happening in the risk space globally especially in regulatory terms. Interesting to see that our Aussie brethren are rolling out comparable risk requirements to AIFMD – see here. The language and tone is remarkably similar. Now whilst this is a (second) draft (and at first reading appears to target banks and insurance companies rather than investment funds) it does again emphasise the clear direction regulators are heading. The key concepts consistent with AIFMD are all there: independent risk, risk profile, risk appetite etc.

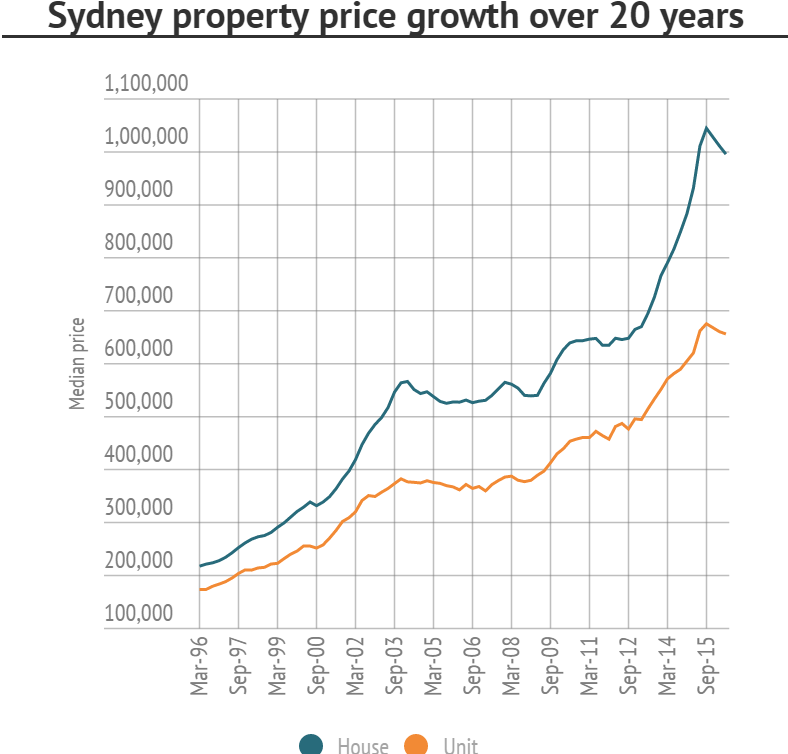

Australia never really had the banking disaster common in Europe and the US but with the commodity slowdown and the uncertainty over China the Aussie housing market is certainly very vulnerable (if not a no-brainer for a collapse). So regulators there want to get ahead of the curve and what better way than to ensure best in class risk management with a focus on independence and comprehensiveness. The open question is whether regulators down there will be as forgiving for non-compliance as they heretofore have been in Europe.

Get in touch

Please contact us if you would like to learn more about our solutions