In October the Securities and Exchange Commission (SEC) adopted liquidity rules1 for mutual funds and ETFs to allow fund boards, the SEC and investors to “better monitor liquidity risks” in those investing vehicles and to “modernize and enhance liquidity risk management”. Whilst the Investment Company Act provides for a seven day settlement period to repay investors this period has shortened over the years for a variety of reasons including faster settlement of transactions in large part thanks to technology. At the same time mutual fund managers are trading ever more complex instruments putting pressure the other way.

“These trends have made the role of fund liquidity and liquidity management more important than ever in reducing the risk that a fund will be unable to meet its obligations to redeeming shareholders or other obligations under applicable law, while also minimizing the impact of those redemptions on the fund (i.e. mitigating investor dilution)”

It would appear the SEC is not impressed with fund managers’ attempts to monitor and manage their liquidity risks suggesting that some funds have “dedicated significantly fewer resources to managing liquidity risk in a formalised way”. This is a definite shot across the bows and indicates what way the SEC is thinking: “Recent events have demonstrated the significant adverse consequences to remaining investors in a fund when it fails to adequately manage liquidity”.

The SEC believes a fund must also consider “both expected requests to redeem, as well as requests to redeem that may not be expected, but are reasonably foreseeable,” when evaluating its liquidity risk. Those familiar with European fund regulations will note that this language is very similar to the provisions of article 39 (1(c)) of AIFMD that suggest an AIFM must take action “when it considers the AIF’s risk profile inconsistent with these limits” or “sees a material risk that the risk profile will become inconsistent with these limits”2.

What both these provisions have in common is the expectation (by regulators at least) that risk in general and/or liquidity can be forecast – a very dangerous assumption at the best of times (tricky during a business-as-usual environment and certainly difficult if not impossible under stressed market conditions).

What this all means in practice is the SEC will expect funds to have a liquidity management process in place. This may involve considerable changes to the funds day to day operations. In particular asset managers and fund boards will need to assess the key factors behind the liquidity of a fund:

“Rule 22e-4 will require each fund to assess, manage, and periodically review (with such review occurring no less frequently than annually) its liquidity risk, considering the following factors:

(i) short-term and long-term cash flow projections, considering size, frequency, and volatility of historical purchases and redemptions of fund shares during normal and stressed periods; the fund’s redemption policies; the fund’s shareholder ownership concentration; the fund’s distribution channels; and the degree of certainty associated with the fund’s short-term and long-term cash flow projections;

(ii) the fund’s investment strategy and liquidity of portfolio investments;

(iii) use of borrowings and derivatives for investment purposes; and

(iv) holdings of cash and cash equivalents, as well as borrowing arrangements and other funding sources

The SEC also proposed guidance on how a fund should asses the liquidity of the actual fund positions:

“Rule 22e-4 as proposed would have required a fund to take into account the following nine factors, to the extent applicable, when classifying the liquidity of each portfolio position in a particular asset:

(1) existence of an active market for the asset, including whether the asset is listed on an exchange, as well as the number, diversity, and quality of market participants;

(2) frequency of trades or quotes for the asset and average daily trading volume of the asset (regardless of whether the asset is a security traded on an exchange);

(3) volatility of trading prices for the asset;

(4) bid-ask spreads for the asset;

(5) whether the asset has a relatively standardized and simple structure;

(6) for fixed income securities, maturity and date of issue;

(7) restrictions on trading of the asset and limitations on transfer of the asset;

(8) the size of the fund’s position in the asset relative to the asset’s average daily trading volume and, as applicable, the number of units of the asset outstanding; and

(9) relationship of the asset to another portfolio asset”

It is rare, certainly in financial circles that the US appears to be behind the European curve (and we haven’t even discussed the swing-pricing proposals the US is looking to introduce which has been a feature in UCITS, along with the anti-dilution levy, for quite a while).

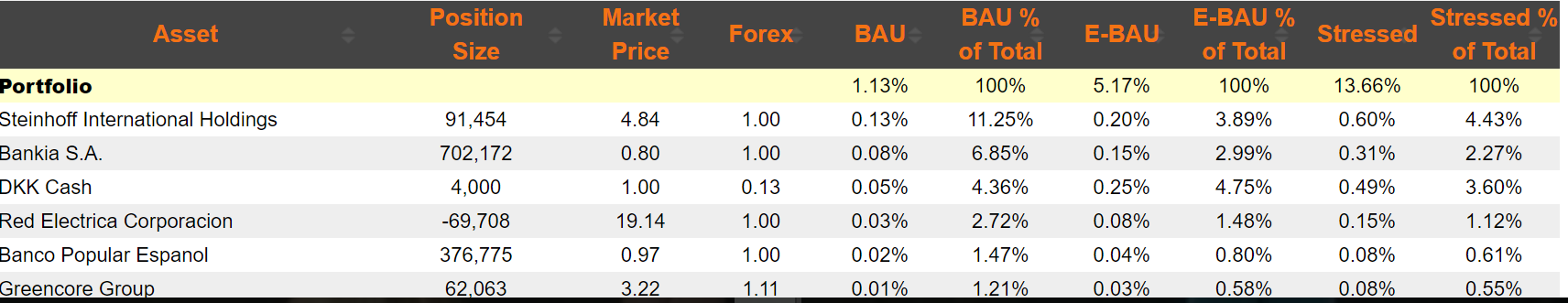

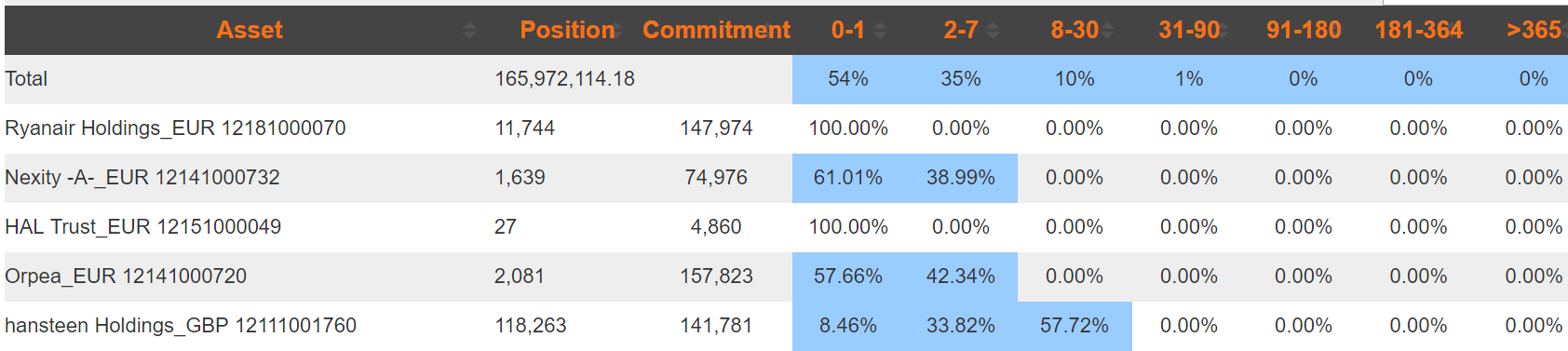

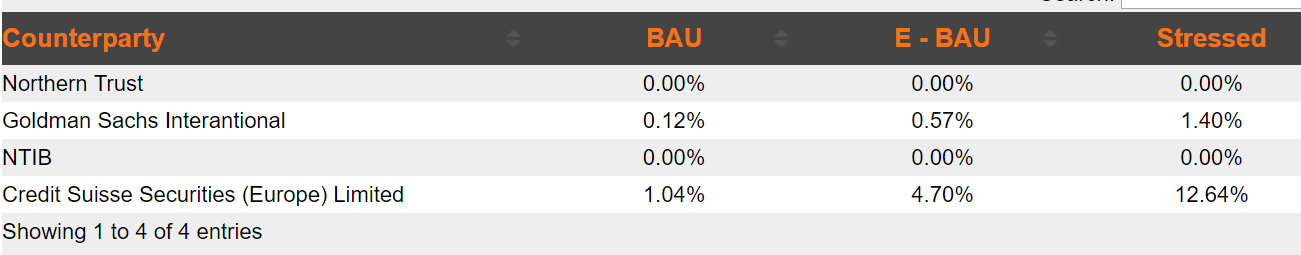

At RiskSystem we have had several years’ experience building and managing liquidity risk programmes driven largely by the onerous requirements of AIFMD – likely to be coming down the tracks for UCITS funds too. We have been modelling market liquidity risk, aggregate counterparty liquidity risk, investor funding information and forecasting redemption scenarios and aggregating these together to allow our clients better understand the liquidity profiles and potential redemption pressures on their funds. The screenshots from RiskSystem below demonstrate those capabilities and we would like to think we are ahead of the SEC expectations in that regards.

Figure 1: Liquidity cost, as a % of NAV under BAU and Stressed Scenarios

Figure 2: Estimated time to liquidation (1% daily volume selected)

Figure 3: Counterparty liquidity cost

[1] https://www.sec.gov/rules/final/2016/33-10233.pdf

[2] Italics added for emphasis